Understanding ITR Filing in India

Income Tax Return (ITR) filing is essential for every earning individual. Whether you’re a small business owner, freelancer, or just starting your professional journey, filing your ITR on time helps you stay compliant and enjoy financial benefits.

Why is ITR Filing Important?

Filing your ITR gives you several advantages:

Avoid Late Fees & Penalties

Claim Tax Refunds

Useful for Loan & Visa Approvals

Acts as Proof of Income

Even if your income is below the taxable limit, filing an ITR can help in many financial situations.

Which ITR Form Should You Use?

Here are the common forms for beginners:

ITR-1 (Sahaj): For salaried individuals with income up to ₹50 lakh

ITR-4 (Sugam): For freelancers and small businesses under the presumptive income scheme

Documents Needed for ITR Filing

To file your return smoothly, keep the following ready:

PAN Card & Aadhaar Card

Bank statements

Income details (salary, freelancing, or business)

Investment/deduction proofs (LIC, 80C, 80D, etc.)

Form 16 (if salaried)

Previous year’s ITR (optional)

How to File ITR Online (The Easy Way)

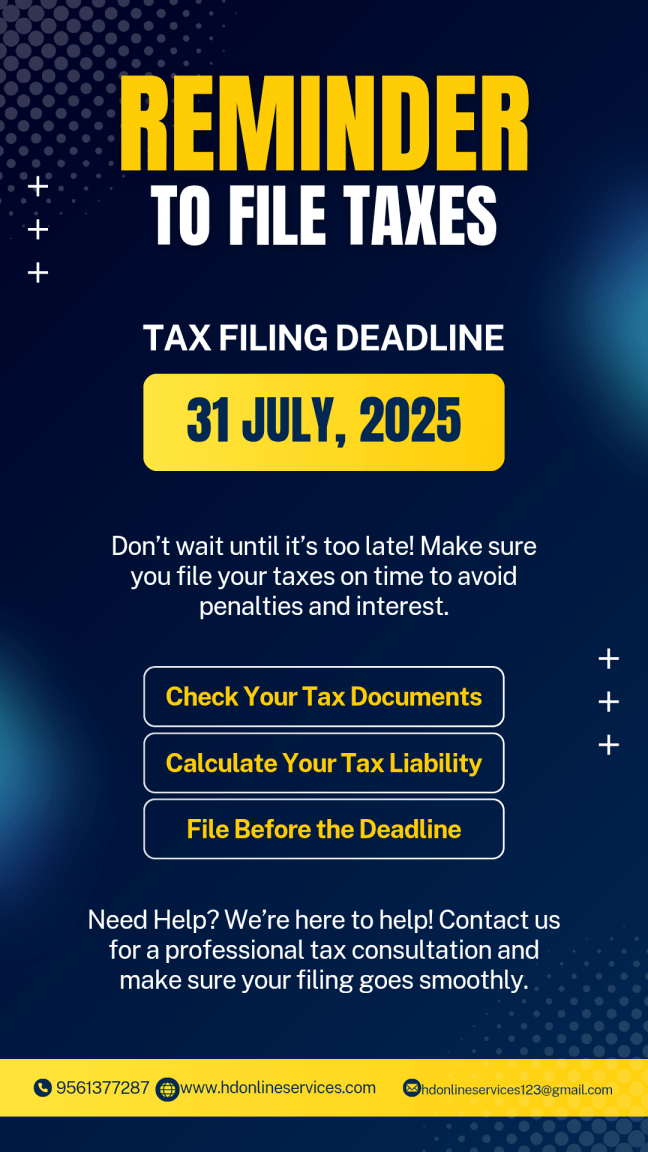

While the government portal allows direct filing, the process can be confusing—especially for first-timers and small business owners. That’s why expert help can save you time and stress.

Let HD Online Services Handle Your ITR Filing

Don’t worry about forms, deductions, or deadlines. At HD Online Services, we provide:

Expert consultation

Accurate ITR filing

Quick turnaround

Affordable charges

Contact us today and file your ITR the smart way!

Address: Nere, Pune, Maharashtra 411033

Website: https://hdonlineservices.com/

Final Tip

Start your ITR filing process early to avoid last-minute stress. If you’re a beginner, get in touch with trusted professionals to ensure everything is done right.